Salesforce Dot Com is not a cloud Utility, it is a customer Amenity

-- The evolution of IT solutions towards increasing Amenity

Over 50% of IBM's revenue comes from services, not from products. In fact, the figure may be higher since sales of tangible goods such as systems, servers and software can easily obscure the associated support.

Now look at companies like Accenture, CSC or CapGemini. 100% of their revenues are in services. Their annual reports do not break out revenue for any of the products they use in the course of delivery, even in areas where they own a product and the intellectual property. This is not just an accounting quirk. Today, IT solutions firms are services firm - fair and square. Being services firms, their greatest assets are their people and their client relationships. They generate revenue when they perform tasks for clients - whether these are visible to them or behind the scenes in support. The role of solutions in businesses like Accenture, CSC and CapGemini is to provide a template for a repeatable service, i.e. a type of project or a style of longer term engagement.

Given the dominance of services to the business growth of IT solution providers, their research and development should focus strongly on services innovations. They are not unique. The trend is called 'servitization'.

Services now account for 80% of the U.S. GDP, with other developed nations showing similarly high percentages. Even product-dominant companies are adding service to their offerings because it is relatively inexpensive to implement, provides recurring revenue, and creates an effective differentiator in an increasingly crowded and commoditized marketplace.

When Jack Welch took over at GE in the early ‘80s, he realized that relying solely on product sales was a short-sighted approach. He shifted the mindset of the company from a one-and-done sales strategy toward creating ongoing revenue streams with clients. GE now sells airplane engines nearly at cost but bundles them with highly profitable, multi-year service contracts.

In 1999, retailer PetSmart refocused its expansion strategy toward caring for the lifetime needs of its customers’ pets. With the addition of grooming, training, and boarding services, PetSmart pulled ahead of the competition and became the largest national provider of pet services. While services account for a relatively small percent of the company's revenue, they continue to comprise a major chunk of its profits.

In a bold move toward increasing service and education for its customers, home improvement retailer Home Depot hand-picked 25 experienced and tech-savvy employees to provide peer-to-peer support for the online community. Armed with flip cameras for DIY videos, the Social Media Store Associates work in-store three days a week and devote two days a week to social media exchanges with customers. Seven months later, the initiative has surpassed expectations of customer engagement and brand loyalty.

In the aerospace industry there is a clear distinction between product (e.g. an aircraft engine) and service (e.g. preventative maintenance). In the Pet industry, no one is going to confuse pet food (product) with pet grooming (service)? Are things quite as clear in IT?

Companies like CSC and Accenture operate in the 'digital' realm. A computer server is just as tangible as Pet food, and IT support is just like pet grooming, yet the trend in IT services is towards hybrid models and capital-intensive business strategies such as Web services, cloud and SaaS (software as a service).

Take Salesforce.com as an example. They provide online business applications to thousands of clients and hundreds of millions of users using a 'multi-tenant' IT architecture. Is Salesforce.com a product, a solution or a service? They are all three. Salesforce provides a level of 'amenity' to their users that seem to be greater than the sum of its parts. What's going on?

When you choose which hotel to book into do you compare the beds? Not unless you are very fussy. Most hotels provide beds of roughly equivalent value. No, you look for other amenities that increase the hotel's attractiveness, value or that contributes to its comfort and convenience. This might include dining, adjacent parks or a golf course, swimming pools, health club, party rooms, theater or media rooms, bike paths, access to city centre and garages. You also compare the customer experience and other environmental factors such as location which add to the desirability of the property. It's a good analogy for how the IT landscape is changing.

In order to attract and retain clients, services are added to products, and amenity is added to services.

Recently, for example, Salesforce added data.com to its market leading application, allowing direct access to Dun&Bradstreet information within their Sales cloud. When this was announced at a recent Salesforce conference, there was a spontaneous outbreak of applause. Users love the convenience.

Salesforce have also extended the structured customer data they manage to include new unstructured social profiles, automatically extracted from online services such as Twitter, Facebook and LinkedIn. In addition, Salesforce have modified their service so that it can used, unchanged, on popular touch-screen devices such as iPads and Android tablets.

The history of Salesforce.com development is dominated by step changes in amenity.

No one buys Salesforce.com based on a feature-function comparison of packaged CRM software. There is no need for such a comparison because the service has become a permanent amenity to its users. And the amenity is developing, and is shaped, by the demands placed upon it by the users. To wit: Mark Benioff, the flamboyant CEO of Salesforce.com, always begins the annual Dreamforce conference by telling the audience that he has been traveling the world and meeting his clients. This is not just PR. His team want to understand how their clients are adopting, shaping and using the service. Benioff is a CEO-journalist, and always takes a film crew with him to document the most surprising client stories.

There is a common thread to these stories. Users report a raft of immediate benefits, just by adopting the service. The transformation appears to be non-disruptive to their business. It's as if an invisible consultant has come in, moved all the chairs and tables around on the deck, without anyone noticing. Amenity is more than value add, it is the confluence of product, solution and service, and it's where the IT industry is heading.

All industries begin in the product domain, proceed through services and end up competing on amenity. The battleground is now customer experience and amenity and it's far more than putting lipstick on a pig.

We all know that the cost of IT has dropped off a cliff. This is called commoditization. It's now possible to buy the equivalent of a super-computer for small change and put it to work in your garage! It's the same with software. What was once expensive and difficult is now cheap and easy. What once attracted premium service is now merely routine. Automation is rife. It's already possible to load up a virtual image of an enterprise application, deploy it on a virtual server, running in a virtual data center, and then scale it 'elastically' to thousands of user and millions of transactions. At the same time, power users can be given their own dashboards for configuring the data and workflow.

Commoditization demands that IT providers innovate upstream, closer to the customer. And that means service and experience innovations.

Customers do not go to Salesforce.com for a product. They know the Salesforce hotel provides the 'bed' and will safely manage their customer data. They don't even go for a solution. They know the core is a market leading CRM application. They go for the experience. They are not only interested in the functionality of Salesforce.com at a point in time, but how it is evolving and what amenity it affords them. They go to be part of the party.

A film maker goes to a film studio to make a film because it provides the required amenity: access to high-end 'creatives', specialized skills, working spaces, equipment, pre- and post-production services and all the other paraphernalia of the movie industry. Salesforce customers go to Salesforce.com to make 'films' that enable them to foster powerful sales disciplines across their organization and instill in their employees a customer-centric culture.

The journey to amenity, and the customer's changing expectation of service 'value', can be categorized by this crude analogy:

Past:

I need meat to order to make a hamburger ... and then ....

I just need great hamburgers - where do I go? ... and then ....

I need hamburgers available everywhere I travel ...

I am looking for a nice environment in which to eat hamburgers ...

I eaten too many hamburgers - fix me up ...

Future:

I need advice on the quantity and frequency of what I eat ...

I would like the hamburgers I eat to keep me healthy ...

Make me healthy and keep it that way

Hamburger corporations that don't understand they are in the healthcare services business, beware! Ditto IT services providers that don't understand they are in their customer's (growth) business.

The supply of any computing system always gives way to demands for the supply of associated support services. Even a consumer device such as the iPad has spawned 100s of web sites and books to help the users make best use of the technology and to clue them into all of the amenity provided in the Apple AppStore. Now, attention is moving to advice and consulting on how best to use that power in the business. One day, I can envisage a business user contemplating the purpose of a new device asking "So, how is this going to transform my business?"

The evolution of the IT services industry is two fold: up the stack to amenity (economies of scope), and down the stack to cloud (economies of scale). You need to know where you are pitching since it is hard to be a company such as Salesforce.com and operate at all points of the spectrum. There is a service chain. Even Salesforce.com outsources many aspects of their business and infrastructure.

Amenity is a good place to be for a services firm. It attracts clients and premium fees. The value of an amenity gains from the increased knowledge accumulated via 1) all of the transactions that pass through it, 2) all of the interactions of the users and 3) each of the use-cases the client brings as requirements for evolution and innovation of the service. Salesforce understood this when they created AppExchange, a marketplace of adjunct applications which can be layered into the service experience. Amenity transforms products into platforms, building many service innovations on a common core and providing these to all customers who choose to engage. Amazon.com is also an amenity for consumer purchases. Each purchase enhances the service for others.

Any service, of any scale, can be changed so as to increase amenity. This is called services innovation. It usually starts by mapping out how an existing service create value for the customer, how the customer experiences the service and how this is supported by the service provider on-stage, back-stage and through the support system and value deliverables. Services innovation methods are then used to explore changes in service choreography.

In a mature amenity such as Salesforce.com or Amazon.com, services innovation is a forever task. And this is the norm for all services. While products and solutions are often delivered and then forgotten, or at least only 'supported', services are continuous. To retain the client they must improve and evolve. Services innovation projects are always about the customer. The goals will be specific. They could be one or more of:

To reduce customer complaints

To pinpoint sources of untapped revenue

To foster customer advocacy

To capture more value from existing clients

To attract new clients

To fill gaps in services before clients go elsewhere

To personalize a service for specific client segments

To generalize a service to increase its appeal

To capture more tacit client information to guide innovation

To drive a clearer service culture and vision

To bring in service partners using an orderly processes

To foster a customer orientation throughout an organization

To achieve economies of scope - more services

To create a memorable customer experience

To grow our service platforms and increase amenity

To create a new customer benchmark in the industry

Services Innovation is the next source of competitive advantage for IT solution providers.

-- Howard Smith, CSC

Salesforce Dot Bomb?

The trend towards 'Amenity' in IT services

Monday, October 10, 2011

Tuesday, March 28, 2006

Will Salesforce.com bomb out in the large enterprise markets, or is the 1-800-NO-SOFTWARE gorilla a bomb under a complacent "big iron" IT industry?

A strong re-emergence of rental and pay-per-use software models signifies that the industry is living in an era of contrived dynamic prosperity, not an imminent threat. Most incumbents will find a way to make hay while the sun lasts. Only Salesforce itself can tell us how long the stay of execution will last.

The force of a one customer strategy

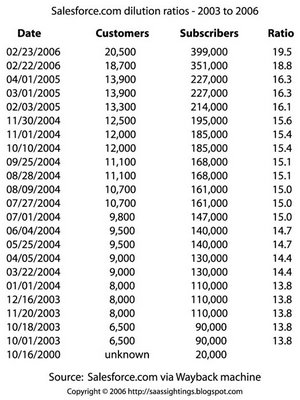

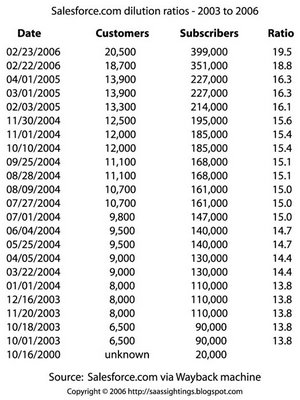

On 23rd of February 2006, Salesforce dot com, poster child of the SaaS (“Software as a service”) movement, announced 399,000 subscribers (users) across 20,500 customers (enterprises). That’s 19.5 users per enterprise. Does that tell us anything?

IT-insiders report that Salesforce has grown rapidly. The company reported earnings for the fourth period ended January 31st rising 66% to US$5.96 million, or five cents a share, from US$3.59 million, or three cents a share, in the year-earlier period. Revenue rose 67% to US$91.1 million. The company predicted revenue in its current fiscal year will hit US$470 million to US$475 million, up as much as 53% from the year ended in January.

So who the heck are Salesforce customers?

Amazon targets the average book Joe, and has extended that lead to DVDs, electronics, apparel and more. Who’s the target for a CRM app? Fortune 500 companies? Mid-market firms? Small-to-medium sized business (SMBs)? Mom and pop shops? All wrong. Salesforce.com targets just one person, the sales guy. In SaaS-lingo that’s a “one customer” strategy.

The theory behind “one customer” is this: Do it right, generalize a SaaS solution for the 1-to-many “Long Tail” mass-market, and all sales guys will sign-on. Subscribe online at a browser near you, bring your colleagues to the party and hey presto, the Sales Team are finally sharing data and (whether the CIO likes it or not) Acme Corp. has a new enterprise app. Now all there is to worry about is that pesky little process called total user adoption: encouraging the rest of the sales organization to follow suit. And if that’s a sweat, no sweat: call Salesforce adoption and consulting partner Blue Wolf Group.

So just who the heck are Salesforce customers? Sales teams who use the simplicity of SaaS to bypass corporate IT or Sales Directors blessed by Corporate IT who proactively choose the Salesforce brand of CRM as an enterprise standard? Fact is, no one other than Salesforce knows.

Let’s go Wayback

Unless you are an avid Salesforce.com groupie you won’t have been watching the company’s WWW home page for the last six years. Fortunately the Wayback Machine, another marvel of the Web, has. A little work yielded:

The dilution ratio, the average number of users per customer, is a reasonable measure of whether Salesforce is penetrating larger firms. If the NO-SOFTWARE company’s subscriber base continues to grow, and the ratio declines or increases only slowly, we can be sure that the company is appealing to the SMBs and Mom and Pop shops – even if Salesforce do manage to retain a few brand name customers. Only if the ratio increases sharply can we be sure that Salesforce is a potential bomb to companies like SAP and Oracle.

SaaS is a channel, the market is for Services

Unlike books and shoes, IT services are not so easy to segment. Will a “one customer” model work at scale amid the Fortune 500 firms? Corporate IT exists because Fortune 500 firms are creatures of process, not chaos. Would a global enterprise survive more than a few weeks if staff were left to choose-and-use the needed IT services piecemeal? Yet even if Salesforce never makes it to the SAP-GE league, the company could still enjoy a healthy business serving the Long Tail, as do Yahoo, Google and Amazon. This schizophrenia is one factor that attracts IT-watchers towards Salesforce.com in particular and to the SaaS-trend more generally. It’s a dilemma that industry analysts have yet to explain. (There’s nothing wrong with the little guy, but industry analysts typically don’t sell to them.) However, the same schizophrenia is also a dilemma for former Oracle executive and Salesforce CEO Mark Benioff. If his CRM baby doesn’t appeal to the Fortune 500, CRM alone won’t cut it as a business model among SMBs. There are already a host SaaS-CRM alternatives out there, with lower per seat costs and, some say, a more appropriate solution for small firms.

And that’s only the beginning of possible problems for the “no software” concept. Fact is: the fate of a company like Salesforce is inextricably linked with the fate of the entire software-as-a-service sector.

Most businesses, even smaller ones, need a lot more IT than CRM. If they can’t get all of the IT services they need as SaaS, CRM as a service makes no effective difference to their IT costs and IT management headache.

In “Software as a service: Pay as you build, but at what cost?” Ephraim Schwartz got to wondering in Computerworld “what if you were committed to the SaaS architecture and needed all 160 programs to run their business properly? With an average service fee of US$50 per user per month multiplied by 160 plug-ins, you get US$8,000 per user per month. Multiply that by 12 months and a dozen users and it comes to US$1,152,000 a year.”

Schwartz’ estimate of 160 is the number of services a typical mid-sized firm might need to subscribe to in order to enjoy the equivalent of a mainstream enterprise “on premise” software solution. It is based on the fragmentation of the SaaS space today, where each service is supplied by a different firm. His conclusion: “SaaS providers will very quickly face the reality that unless they are a provider of a major service with broad reach, they will not be able to charge even US$25 every month for each user. Expect prices for nice-to-have utilities to drop as low as US$5 per seat each month.” And don’t expect the problems to stop there. While many companies will adopt discrete services, integration, aggregation, consistent user interface and a host of other factors will force the emergence of SaaS channel providers, who will integrate at the backend, and the front end of the services supply chain.

Is Salesforce a force?

With doubt over Fortune 500 credentials, pressure from online CRM alternatives and a CRM-is-not-enough business case even among SMBs, it’s no wonder that Salesforce has launched AppExchange.

Working with ISVs, the company is extending its value-proposition by offering related or complementary applications. Can Salesforce capture the SMB business-IT service chain? Technically, it’s possible. And no doubt the company has a sophisticated model for wresting further revenue per user based on take-up of additional service via AppExchange. Indeed, March 6th 2006, Salesforce upped prices for Fortune 500 premium services, by nearly a factor of four! The move is the latest step toward delivering bundled services beyond customer relationship management (CRM) “Front Office” applications. Analysts said it could help Salesforce.com compete against bigger rivals Microsoft Corp., Oracle Corp. and SAP AG by providing tools to make building out platforms and deploying related applications. And Salesforce provide tools to integrate back into on-premise core systems – which are unlikely to fall under the SaaS hammer.

Could it be that AppExchange is a signal that executives at the firm concluded a year ago or more that the original CRM-only play was unviable unless more sizeable firms signed-up in scale. With a weak dilution ratio, and unless AppExchange becomes a “destination” on the scale of Google or Amazon, it’s curtains for Salesforce.com as poster-child of the much-talked-about “disruptive” transformation of the large enterprise software economy signaled by SaaS.

Look at Amazon. What began with books, expanded to Videos and DVDs, then to toys and electronics, onto apparel, fashion accessories, beauty products, gourmet foods, jewellery, shoes, musical instruments, health products, furniture, bed and bath, kitchen ware, pet suppliers, tools and automotive.

Categories at Amazon expanded wildly not just because it was possible to ship them from the warehouse, but because other online retailers would quickly erode the business case for a niche “books only” Amazon. The same will be true of Salesforce.com, once selling software begins to resemble selling any other form of online content.

Who cares who pays?

The problem for Benioff and team is that on every conceivable podium they cannot resist touting the brand-name customers they have picked up. Like the intro to a Star Wars movie, the latest names scroll up and fade into the distance on their home page.

Many of the company’s executives spent the earlier part of their working life amid Big Iron IT, a world dominated by cash-rich IT spenders eager to wrest competitive advantage from protracted “on premise” enterprise software projects. So far, Nick Carr is wrong, it’s not yet the end of Corporate IT. Those projects are, and were, deeply dependent upon veritable armies of consultants to customize and adopt software to fit unique business processes. (look to BPM for help) Hats-off to Salesforce for trying to disrupt a status quo, but the simplicity of one-click sign-up to CRM belies a greater complexity. As Nick Carr has pointed out, IT “no longer matters” if equivalent IT is equally accessible to all. Will Fortune 500 CIOs value Salesforce or its equivalents when Mom and Pop can sign-up on the same terms with one-click? Does the SaaS model by design drive towards commodity?

When the Fortune 500 adopts commodity services, they will be valuing commoditization, not differentiation. Just as quickly they will move onto new territory, areas of IT where they can differentiate, not corrode, competitive advantages.

And won’t they get nervous if their Fortune-listed friends aren’t also Salesforce users? If SaaS is as easy as people say it is won’t there be a host of options in the market. Already there are SaaS-enablers offering an “easy as 1-2-3” process: 60 days to SaaS: Wrap, Host and Serve.

And what will SMB firms think about subsidising larger firms so that they can enjoy a low cost of instant-on rental software? Won’t Salesforce be forced to find ways to extract even more cash from the cash rich?

Who has the Force?

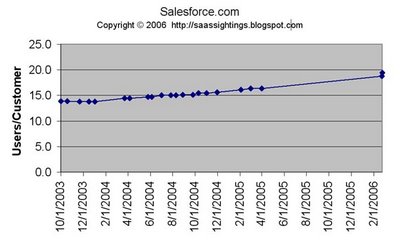

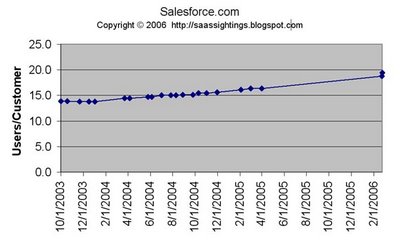

Business may be moving at SalesForce.com, but it is moving slowly. Since October the 1st 2003, the dilution ratio has increased by only six, from 13.8 to 19.5. The chart is near linear over the range.

A slight jump at the end of February 2006 may signify that existing customers are adding seats. Alternately it may just be a delay in publishing or tallying figures to coincide with earning press.

No doubt Salesforce does enjoy a small number of “showcase” brands among its 20,500 “customers”. No doubt some “customers” have hundreds, or even low thousands, of users. Even so (and assuming linear growth continues) Salesforce does appear to be playing firmly in the SMB and Mom and Pop Shop markets. Watching Benioff on-stage make hay of the brand names that, as the company says, “have the Force”, one cannot help that queasy feeling that even wins might be a push once SAP and Oracle get their SaaS act together.

More demographic information is needed before final conclusions are drawn.

Building out scale

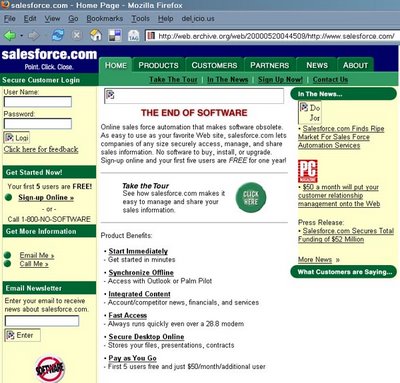

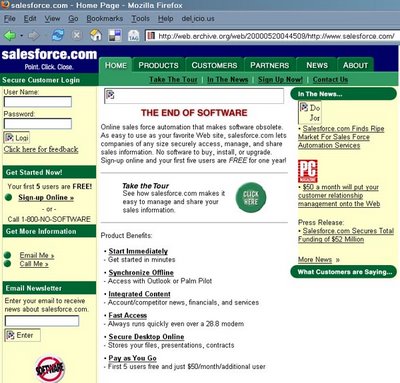

An image of the Salesforce.com home page from May 2000 is revealing.

One year in, the start-up had raised US$52 million in venture capital investment. At the time, rental of the CRM app would set you back $50/month/user. The company was giving away five free users to drive adoption. Today, rental is $65/month/user, with discounts for volume. That’s six years to drive per seat cost $15/month. (putting side the recent 4x increase for premium “Fortune” service)

Assuming all users pay the full $65 (which is unlikely), today’s 399,000 subscribers bring in US$25,935,000 per month. That is the equivalent of a typical Fortune 500 enterprise-IT project each month. Those companies have serious IT-work in their markets. But it’s nothing to do with CRM. Aerospace, healthcare, finance, government and biotech don’t “run on CRM”.

Twelve projects a year is hardly a market disruption. And with pressure on per-seat costs growing among CRM competitors, SaaS announcements starting to flow from incumbents getting into the game and an urgent pressure to build out beyond CRM, Salesforce is hardly done and dusted.

Is Christensen’s model appropriate?

The debate about SaaS raging in the Blogosphere will no doubt be informed by the progress of Salesforce. Analysts IDC are making some noise.

IDC have a partnership with Innosight – the strategy firm founded by disruptive innovation guru Clayton Christensen. The group has virtually announced that SaaS signifies a classical Christensen disruption. The innovation guru’s name, and the term SaaS, appear on at least one Web page.

According to the theory, SaaS targets overshot customers in less-demanding tiers of a market with a “good enough” product or service at lower price point. Signals of overshot customers include: people complaining about overly complex (“On premise” software – “armies” of consultants) and/or expensive products/services (“SAP license upgrades”) and features not getting used/valued (software licenses “sitting on shelves”, 85% of software package features irrelevant to most users). Sounds plausible?

Drawing analogies with Salesforce, analysts are pointing towards other “disruption indicators” giving credence to the theory. These include the emergence of a “different” business model (rental, pay per use), “new” technologies (AppExchange “platform”), simplified cost structures (“customer of one” – no need for sales staff) and fluid distribution systems (Web service chain) that add up to attractive profits at lower price points.

It is possible to point to other “litmus tests” as evidence that the IT industry is undergoing a significant change with SaaS. For non-customers (enterprise business units waiting for applications Corporate IT have failed to deliver), does the product or service (“SaaS marketplace”) help customers accomplish an important, unsatisfied job; or is success predicated upon their wanting to get done something that historically hasn’t been prioritized? Or does it (SaaS) compete against non-consumption – enabling a larger population of less-skilled or less-wealthy people (“business users without IT skills held captive by IT departments”) do things that previously had not been possible? All roads seem to point to a disruption: but to whom?

With SaaS and Web 2.0 announcements now flowing from virtually every ISV on the planet (http://saassightings.blogspot.com) does Salesforce even matter any more as a barometer of the SaaS trend? In so far as the company is a litmus-test of a Christensen disruption, yes. If the movement’s poster child fails to penetrate the Fortune 500 at scale, or only appeals to smaller enterprises, SAP and their ilk, together with their extensive networks of after-sales services and support, can sleep easy in the knowledge that monolithic, bloated and over-priced offerings are safe, for a while. If, on the other hand, Salesforce only succeeds among large firms and fails to reach out to the little guys, it and similar offerings can be viewed as “just another app” and the new technology of AJAX and Web 2.0 as little more than a fancy-browser front-end (remembers XWindows). In such a case, the software manufacturers will be unaffected, but consultants had better embrace off-premise development and evolutionary development methods. Vertical integration between content, service and consultancy will be the mantra if SaaS succeeds.

The real Bomb for the IT industry would be if the “one customer” strategy succeeds and the Salesforce subscriber demographic (via the dilution curve) signifies universal appeal – the Flower Shop and GE – evenly distributed. In this case, and in this case alone, CEO Mark Benioff will have cast a fatal blow and triggered a genuine new software economy. That data is not yet in. Everyone is biting their nails.

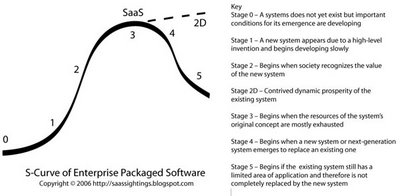

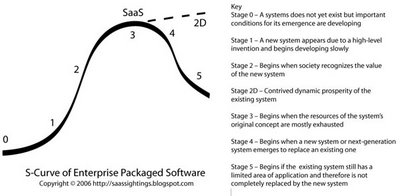

So until Benioff and team publish more demographics, there remains a doubt over whether Salesforce is a Christensen disruption (Threat to incumbents, Opportunity for the new guy) and if so, to whom. Where there is no doubt is that the IT industry is now living in an era of contrived dynamic prosperity.

Living on borrowed time

Contrived dynamic prosperity is an aberration of the standard S-curve of organizational and technological development. It’s a state in which the threats and opportunities surrounding an innovation play against each other, orchestrated by old and new players in the market: those who seek to save the status quo (SAP, consultants etc.) and the other seeking to change it (i.e. Salesforce, SaaS models).

Contrived dynamic prosperity prevents the natural aging of incumbents and assures the achievement of the desired lifecycle of the organization, that is, sustainability through growth, defying stagnation in stage 4. Growth as a result of contrived prosperity is rarely dramatic, but it remains reliable. In addition to the existing hierarchy of control (the “on premise” IT orthodoxy pre-Salesforce), an inverted hierarchy emerges that is required to control, cooperate with, and oppose (within limits) the up-start (i.e. “customer of one”).

The business leader in the time of contrived prosperity usually understands and accepts the prevailing incumbent internal and industry culture and does not attempt to replace it, rather, they attempt to work it to their advantage. A recent example can be found in the SaaS announcements of IBM.

IBM is trying, but will fail, to control the SaaS movement by expanding its resource allocation to application partners keen to embrace SaaS and so drive revenue to its own applications hosting businesses. No doubt revenues will be generated, but if SaaS is real, control it you cannot (as Yoda who really does have the force, would say).

IBM is boosting the number of its ISV partners via a “SaaS showcase”, implying that offerings from elsewhere (i.e. the Web) are somehow inferior or risky. They are not. IBM is offering incentives through its extensive business networks to entrap deals at the earliest stage and drive a focus and attention to its own hosting/provisioning services. Access to local IBM sales staff is promised to “add credibility” to SaaS-vendor sales efforts going on in among IBM target customers. This has, for some time, included the mid market.

Having moved out of the applications space, IBM is now encouraging adoption of SaaS by providing ISVs access to its sales staff to help close deals that result in a slice of IBM revenue. The company has opened “virtual innovation centres” to provide guidance to intellectual property owners (software firms) on how to make their offerings available in the IBM On-Demand environment. In a quid pro quo, IBM is offering its own direct mail and telemarketing resources to ISVs moving to SaaS in order to help them generate leads, leading of course to further take up of IBM hosting. Workshops by IBM architects are already touting the advantages of the SaaS model (remember SOA) and advising ISVs on software transformation, service-design and security implications. Buyer-beware: an initiative to develop standards for SaaS interoperability has begun.

IBM’s defensive moves to control SaaS are one signal that, unlike the previous era of failed Applications Services Providers (ASPs) who never cracked the multi-tenant architecture, the industry has, this time, entered the contrived dynamic prosperity stage of its evolution. It’s not the "end of software" Mark, but it might be an end to complacency.

Come on Salesforce, publish the Demographics Force. Mean, mode and medium please, Mom and Pops, Small Enterprise, Mid Market, Global 5000 and Fortune 500. We’ll then know more about how long this new and troubling stage in our industry is likely to last. Are you the Bomb, or will you Bomb-out in enterprise markets even if you succeed to be IT-Guy to the little guy?

Copyright © 2006 Howard Smith

A strong re-emergence of rental and pay-per-use software models signifies that the industry is living in an era of contrived dynamic prosperity, not an imminent threat. Most incumbents will find a way to make hay while the sun lasts. Only Salesforce itself can tell us how long the stay of execution will last.

The force of a one customer strategy

On 23rd of February 2006, Salesforce dot com, poster child of the SaaS (“Software as a service”) movement, announced 399,000 subscribers (users) across 20,500 customers (enterprises). That’s 19.5 users per enterprise. Does that tell us anything?

IT-insiders report that Salesforce has grown rapidly. The company reported earnings for the fourth period ended January 31st rising 66% to US$5.96 million, or five cents a share, from US$3.59 million, or three cents a share, in the year-earlier period. Revenue rose 67% to US$91.1 million. The company predicted revenue in its current fiscal year will hit US$470 million to US$475 million, up as much as 53% from the year ended in January.

So who the heck are Salesforce customers?

Amazon targets the average book Joe, and has extended that lead to DVDs, electronics, apparel and more. Who’s the target for a CRM app? Fortune 500 companies? Mid-market firms? Small-to-medium sized business (SMBs)? Mom and pop shops? All wrong. Salesforce.com targets just one person, the sales guy. In SaaS-lingo that’s a “one customer” strategy.

The theory behind “one customer” is this: Do it right, generalize a SaaS solution for the 1-to-many “Long Tail” mass-market, and all sales guys will sign-on. Subscribe online at a browser near you, bring your colleagues to the party and hey presto, the Sales Team are finally sharing data and (whether the CIO likes it or not) Acme Corp. has a new enterprise app. Now all there is to worry about is that pesky little process called total user adoption: encouraging the rest of the sales organization to follow suit. And if that’s a sweat, no sweat: call Salesforce adoption and consulting partner Blue Wolf Group.

So just who the heck are Salesforce customers? Sales teams who use the simplicity of SaaS to bypass corporate IT or Sales Directors blessed by Corporate IT who proactively choose the Salesforce brand of CRM as an enterprise standard? Fact is, no one other than Salesforce knows.

Let’s go Wayback

Unless you are an avid Salesforce.com groupie you won’t have been watching the company’s WWW home page for the last six years. Fortunately the Wayback Machine, another marvel of the Web, has. A little work yielded:

The dilution ratio, the average number of users per customer, is a reasonable measure of whether Salesforce is penetrating larger firms. If the NO-SOFTWARE company’s subscriber base continues to grow, and the ratio declines or increases only slowly, we can be sure that the company is appealing to the SMBs and Mom and Pop shops – even if Salesforce do manage to retain a few brand name customers. Only if the ratio increases sharply can we be sure that Salesforce is a potential bomb to companies like SAP and Oracle.

SaaS is a channel, the market is for Services

Unlike books and shoes, IT services are not so easy to segment. Will a “one customer” model work at scale amid the Fortune 500 firms? Corporate IT exists because Fortune 500 firms are creatures of process, not chaos. Would a global enterprise survive more than a few weeks if staff were left to choose-and-use the needed IT services piecemeal? Yet even if Salesforce never makes it to the SAP-GE league, the company could still enjoy a healthy business serving the Long Tail, as do Yahoo, Google and Amazon. This schizophrenia is one factor that attracts IT-watchers towards Salesforce.com in particular and to the SaaS-trend more generally. It’s a dilemma that industry analysts have yet to explain. (There’s nothing wrong with the little guy, but industry analysts typically don’t sell to them.) However, the same schizophrenia is also a dilemma for former Oracle executive and Salesforce CEO Mark Benioff. If his CRM baby doesn’t appeal to the Fortune 500, CRM alone won’t cut it as a business model among SMBs. There are already a host SaaS-CRM alternatives out there, with lower per seat costs and, some say, a more appropriate solution for small firms.

And that’s only the beginning of possible problems for the “no software” concept. Fact is: the fate of a company like Salesforce is inextricably linked with the fate of the entire software-as-a-service sector.

Most businesses, even smaller ones, need a lot more IT than CRM. If they can’t get all of the IT services they need as SaaS, CRM as a service makes no effective difference to their IT costs and IT management headache.

In “Software as a service: Pay as you build, but at what cost?” Ephraim Schwartz got to wondering in Computerworld “what if you were committed to the SaaS architecture and needed all 160 programs to run their business properly? With an average service fee of US$50 per user per month multiplied by 160 plug-ins, you get US$8,000 per user per month. Multiply that by 12 months and a dozen users and it comes to US$1,152,000 a year.”

Schwartz’ estimate of 160 is the number of services a typical mid-sized firm might need to subscribe to in order to enjoy the equivalent of a mainstream enterprise “on premise” software solution. It is based on the fragmentation of the SaaS space today, where each service is supplied by a different firm. His conclusion: “SaaS providers will very quickly face the reality that unless they are a provider of a major service with broad reach, they will not be able to charge even US$25 every month for each user. Expect prices for nice-to-have utilities to drop as low as US$5 per seat each month.” And don’t expect the problems to stop there. While many companies will adopt discrete services, integration, aggregation, consistent user interface and a host of other factors will force the emergence of SaaS channel providers, who will integrate at the backend, and the front end of the services supply chain.

Is Salesforce a force?

With doubt over Fortune 500 credentials, pressure from online CRM alternatives and a CRM-is-not-enough business case even among SMBs, it’s no wonder that Salesforce has launched AppExchange.

Working with ISVs, the company is extending its value-proposition by offering related or complementary applications. Can Salesforce capture the SMB business-IT service chain? Technically, it’s possible. And no doubt the company has a sophisticated model for wresting further revenue per user based on take-up of additional service via AppExchange. Indeed, March 6th 2006, Salesforce upped prices for Fortune 500 premium services, by nearly a factor of four! The move is the latest step toward delivering bundled services beyond customer relationship management (CRM) “Front Office” applications. Analysts said it could help Salesforce.com compete against bigger rivals Microsoft Corp., Oracle Corp. and SAP AG by providing tools to make building out platforms and deploying related applications. And Salesforce provide tools to integrate back into on-premise core systems – which are unlikely to fall under the SaaS hammer.

Could it be that AppExchange is a signal that executives at the firm concluded a year ago or more that the original CRM-only play was unviable unless more sizeable firms signed-up in scale. With a weak dilution ratio, and unless AppExchange becomes a “destination” on the scale of Google or Amazon, it’s curtains for Salesforce.com as poster-child of the much-talked-about “disruptive” transformation of the large enterprise software economy signaled by SaaS.

Look at Amazon. What began with books, expanded to Videos and DVDs, then to toys and electronics, onto apparel, fashion accessories, beauty products, gourmet foods, jewellery, shoes, musical instruments, health products, furniture, bed and bath, kitchen ware, pet suppliers, tools and automotive.

Categories at Amazon expanded wildly not just because it was possible to ship them from the warehouse, but because other online retailers would quickly erode the business case for a niche “books only” Amazon. The same will be true of Salesforce.com, once selling software begins to resemble selling any other form of online content.

Who cares who pays?

The problem for Benioff and team is that on every conceivable podium they cannot resist touting the brand-name customers they have picked up. Like the intro to a Star Wars movie, the latest names scroll up and fade into the distance on their home page.

Many of the company’s executives spent the earlier part of their working life amid Big Iron IT, a world dominated by cash-rich IT spenders eager to wrest competitive advantage from protracted “on premise” enterprise software projects. So far, Nick Carr is wrong, it’s not yet the end of Corporate IT. Those projects are, and were, deeply dependent upon veritable armies of consultants to customize and adopt software to fit unique business processes. (look to BPM for help) Hats-off to Salesforce for trying to disrupt a status quo, but the simplicity of one-click sign-up to CRM belies a greater complexity. As Nick Carr has pointed out, IT “no longer matters” if equivalent IT is equally accessible to all. Will Fortune 500 CIOs value Salesforce or its equivalents when Mom and Pop can sign-up on the same terms with one-click? Does the SaaS model by design drive towards commodity?

When the Fortune 500 adopts commodity services, they will be valuing commoditization, not differentiation. Just as quickly they will move onto new territory, areas of IT where they can differentiate, not corrode, competitive advantages.

And won’t they get nervous if their Fortune-listed friends aren’t also Salesforce users? If SaaS is as easy as people say it is won’t there be a host of options in the market. Already there are SaaS-enablers offering an “easy as 1-2-3” process: 60 days to SaaS: Wrap, Host and Serve.

And what will SMB firms think about subsidising larger firms so that they can enjoy a low cost of instant-on rental software? Won’t Salesforce be forced to find ways to extract even more cash from the cash rich?

Who has the Force?

Business may be moving at SalesForce.com, but it is moving slowly. Since October the 1st 2003, the dilution ratio has increased by only six, from 13.8 to 19.5. The chart is near linear over the range.

A slight jump at the end of February 2006 may signify that existing customers are adding seats. Alternately it may just be a delay in publishing or tallying figures to coincide with earning press.

No doubt Salesforce does enjoy a small number of “showcase” brands among its 20,500 “customers”. No doubt some “customers” have hundreds, or even low thousands, of users. Even so (and assuming linear growth continues) Salesforce does appear to be playing firmly in the SMB and Mom and Pop Shop markets. Watching Benioff on-stage make hay of the brand names that, as the company says, “have the Force”, one cannot help that queasy feeling that even wins might be a push once SAP and Oracle get their SaaS act together.

More demographic information is needed before final conclusions are drawn.

Building out scale

An image of the Salesforce.com home page from May 2000 is revealing.

One year in, the start-up had raised US$52 million in venture capital investment. At the time, rental of the CRM app would set you back $50/month/user. The company was giving away five free users to drive adoption. Today, rental is $65/month/user, with discounts for volume. That’s six years to drive per seat cost $15/month. (putting side the recent 4x increase for premium “Fortune” service)

Assuming all users pay the full $65 (which is unlikely), today’s 399,000 subscribers bring in US$25,935,000 per month. That is the equivalent of a typical Fortune 500 enterprise-IT project each month. Those companies have serious IT-work in their markets. But it’s nothing to do with CRM. Aerospace, healthcare, finance, government and biotech don’t “run on CRM”.

Twelve projects a year is hardly a market disruption. And with pressure on per-seat costs growing among CRM competitors, SaaS announcements starting to flow from incumbents getting into the game and an urgent pressure to build out beyond CRM, Salesforce is hardly done and dusted.

Is Christensen’s model appropriate?

The debate about SaaS raging in the Blogosphere will no doubt be informed by the progress of Salesforce. Analysts IDC are making some noise.

IDC have a partnership with Innosight – the strategy firm founded by disruptive innovation guru Clayton Christensen. The group has virtually announced that SaaS signifies a classical Christensen disruption. The innovation guru’s name, and the term SaaS, appear on at least one Web page.

According to the theory, SaaS targets overshot customers in less-demanding tiers of a market with a “good enough” product or service at lower price point. Signals of overshot customers include: people complaining about overly complex (“On premise” software – “armies” of consultants) and/or expensive products/services (“SAP license upgrades”) and features not getting used/valued (software licenses “sitting on shelves”, 85% of software package features irrelevant to most users). Sounds plausible?

Drawing analogies with Salesforce, analysts are pointing towards other “disruption indicators” giving credence to the theory. These include the emergence of a “different” business model (rental, pay per use), “new” technologies (AppExchange “platform”), simplified cost structures (“customer of one” – no need for sales staff) and fluid distribution systems (Web service chain) that add up to attractive profits at lower price points.

It is possible to point to other “litmus tests” as evidence that the IT industry is undergoing a significant change with SaaS. For non-customers (enterprise business units waiting for applications Corporate IT have failed to deliver), does the product or service (“SaaS marketplace”) help customers accomplish an important, unsatisfied job; or is success predicated upon their wanting to get done something that historically hasn’t been prioritized? Or does it (SaaS) compete against non-consumption – enabling a larger population of less-skilled or less-wealthy people (“business users without IT skills held captive by IT departments”) do things that previously had not been possible? All roads seem to point to a disruption: but to whom?

With SaaS and Web 2.0 announcements now flowing from virtually every ISV on the planet (http://saassightings.blogspot.com) does Salesforce even matter any more as a barometer of the SaaS trend? In so far as the company is a litmus-test of a Christensen disruption, yes. If the movement’s poster child fails to penetrate the Fortune 500 at scale, or only appeals to smaller enterprises, SAP and their ilk, together with their extensive networks of after-sales services and support, can sleep easy in the knowledge that monolithic, bloated and over-priced offerings are safe, for a while. If, on the other hand, Salesforce only succeeds among large firms and fails to reach out to the little guys, it and similar offerings can be viewed as “just another app” and the new technology of AJAX and Web 2.0 as little more than a fancy-browser front-end (remembers XWindows). In such a case, the software manufacturers will be unaffected, but consultants had better embrace off-premise development and evolutionary development methods. Vertical integration between content, service and consultancy will be the mantra if SaaS succeeds.

The real Bomb for the IT industry would be if the “one customer” strategy succeeds and the Salesforce subscriber demographic (via the dilution curve) signifies universal appeal – the Flower Shop and GE – evenly distributed. In this case, and in this case alone, CEO Mark Benioff will have cast a fatal blow and triggered a genuine new software economy. That data is not yet in. Everyone is biting their nails.

So until Benioff and team publish more demographics, there remains a doubt over whether Salesforce is a Christensen disruption (Threat to incumbents, Opportunity for the new guy) and if so, to whom. Where there is no doubt is that the IT industry is now living in an era of contrived dynamic prosperity.

Living on borrowed time

Contrived dynamic prosperity is an aberration of the standard S-curve of organizational and technological development. It’s a state in which the threats and opportunities surrounding an innovation play against each other, orchestrated by old and new players in the market: those who seek to save the status quo (SAP, consultants etc.) and the other seeking to change it (i.e. Salesforce, SaaS models).

Contrived dynamic prosperity prevents the natural aging of incumbents and assures the achievement of the desired lifecycle of the organization, that is, sustainability through growth, defying stagnation in stage 4. Growth as a result of contrived prosperity is rarely dramatic, but it remains reliable. In addition to the existing hierarchy of control (the “on premise” IT orthodoxy pre-Salesforce), an inverted hierarchy emerges that is required to control, cooperate with, and oppose (within limits) the up-start (i.e. “customer of one”).

The business leader in the time of contrived prosperity usually understands and accepts the prevailing incumbent internal and industry culture and does not attempt to replace it, rather, they attempt to work it to their advantage. A recent example can be found in the SaaS announcements of IBM.

IBM is trying, but will fail, to control the SaaS movement by expanding its resource allocation to application partners keen to embrace SaaS and so drive revenue to its own applications hosting businesses. No doubt revenues will be generated, but if SaaS is real, control it you cannot (as Yoda who really does have the force, would say).

IBM is boosting the number of its ISV partners via a “SaaS showcase”, implying that offerings from elsewhere (i.e. the Web) are somehow inferior or risky. They are not. IBM is offering incentives through its extensive business networks to entrap deals at the earliest stage and drive a focus and attention to its own hosting/provisioning services. Access to local IBM sales staff is promised to “add credibility” to SaaS-vendor sales efforts going on in among IBM target customers. This has, for some time, included the mid market.

Having moved out of the applications space, IBM is now encouraging adoption of SaaS by providing ISVs access to its sales staff to help close deals that result in a slice of IBM revenue. The company has opened “virtual innovation centres” to provide guidance to intellectual property owners (software firms) on how to make their offerings available in the IBM On-Demand environment. In a quid pro quo, IBM is offering its own direct mail and telemarketing resources to ISVs moving to SaaS in order to help them generate leads, leading of course to further take up of IBM hosting. Workshops by IBM architects are already touting the advantages of the SaaS model (remember SOA) and advising ISVs on software transformation, service-design and security implications. Buyer-beware: an initiative to develop standards for SaaS interoperability has begun.

IBM’s defensive moves to control SaaS are one signal that, unlike the previous era of failed Applications Services Providers (ASPs) who never cracked the multi-tenant architecture, the industry has, this time, entered the contrived dynamic prosperity stage of its evolution. It’s not the "end of software" Mark, but it might be an end to complacency.

Come on Salesforce, publish the Demographics Force. Mean, mode and medium please, Mom and Pops, Small Enterprise, Mid Market, Global 5000 and Fortune 500. We’ll then know more about how long this new and troubling stage in our industry is likely to last. Are you the Bomb, or will you Bomb-out in enterprise markets even if you succeed to be IT-Guy to the little guy?

Copyright © 2006 Howard Smith

Subscribe to:

Posts (Atom)